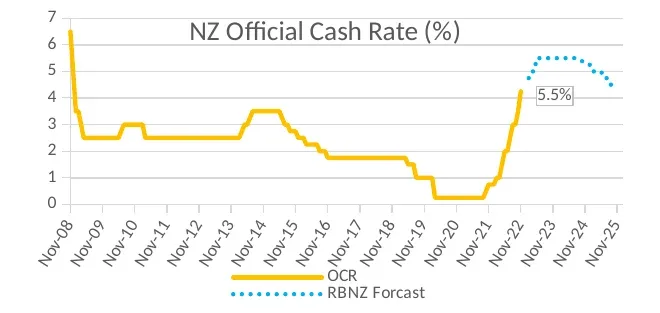

Our theme this month is inflation and interest rates, the relationship between them and what this means for your investments.

Similar Posts

Newsletter – September 2024

Our theme this month is Trump vs Harris – what the different parties are offering and how the US Presidential election may affect the markets.

Newsletter – February 2025

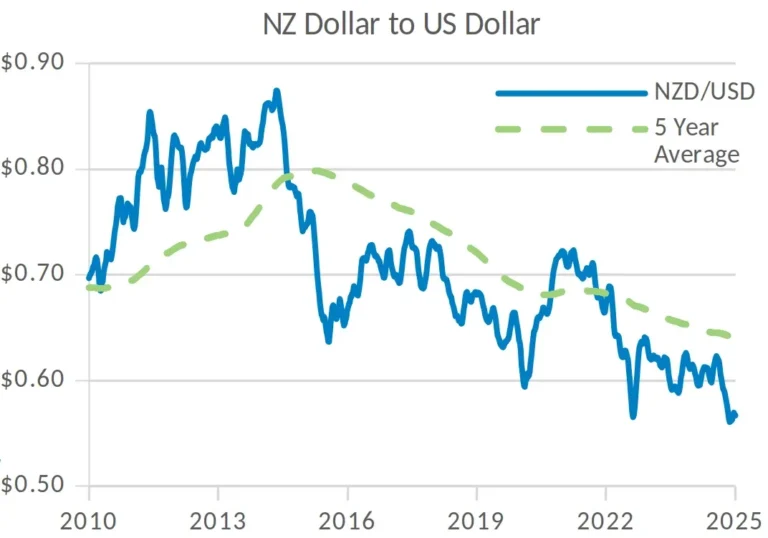

This month we discuss currency – the opportunities a weaker New Zealand dollar creates for your investments and how we cushion against currency volatility.

Newsletter – November 2022

The Reserve Bank of New Zealand is getting tough on inflation. The relationship between interest rates and inflation and what this means for your investments.

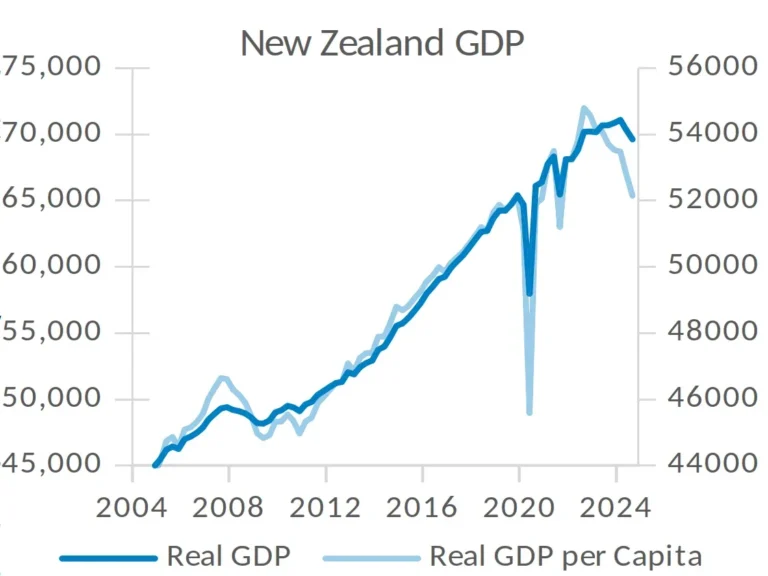

Newsletter – January 2025

This month we check in on the NZ Economy and the role of GDP as an indicator of growth.

Newsletter – April 2022

Widening Booster’s direct investments in attractive, unlisted NZ assets – helping local Iwi fund the purchase of 40 Wellington school properties.

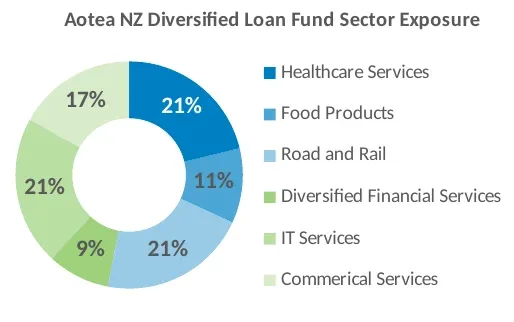

Newsletter – August 2022

Broadening Booster’s direct investments in attractive, unlisted NZ assets – Aotea Asset Management.