This issue explains recency bias, a phenomenon whereby investors let short-term performance influence their decisions, and ways to counter this, instead seeing the silver lining in market volatility.

Similar Posts

Newsletter – March 2024

This month we unpack diversification. Diversification is a strategy to lower investment risk by spreading money across and within different asset classes, such as shares, bonds and cash. It’s one of the best ways to weather market ups and downs and maintain the potential for growth.

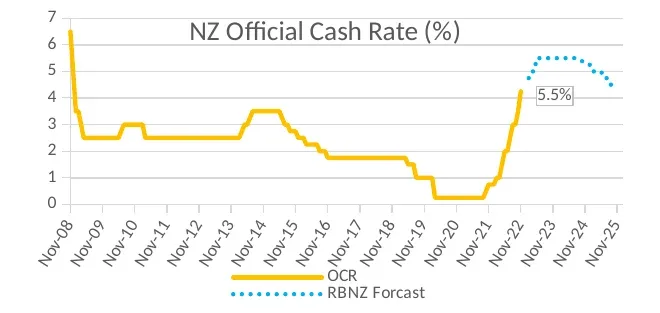

Newsletter – November 2022

The Reserve Bank of New Zealand is getting tough on inflation. The relationship between interest rates and inflation and what this means for your investments.

Newsletter – March 2025

This month we unpack what a tariff is, and some of the ways we manage portfolios during uncertain times like this.

Newsletter – January 2022

It’s been an eventful start to the year. Tensions have been rising between Russia and Ukraine and central banks around the world are looking to increase interest rates.

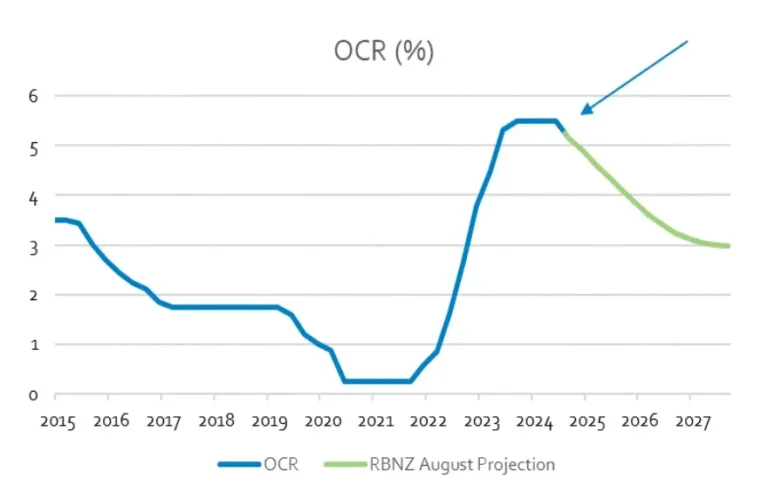

Newsletter – August 2024

Our theme this month is interest rates. After the highest interest rates since 2008, the Official Cash Rate (OCR) was cut in August, marking the first cut since 2020. In this newsletter we outline what lower interest rates mean for your portfolio.

Newsletter – September 2021

This issue uncovers what ‘responsible investing’ means following being recognised as a Responsible Investment Leader by the Responsible Investment Association Australasia (RIAA).