Newsletter – January 2023

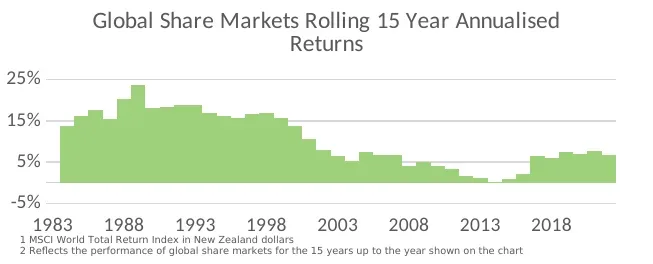

This issue explains recency bias, a phenomenon whereby investors let short-term performance influence their decisions, and ways to counter this, instead seeing the silver lining in market volatility.

Regular newsletters.

This issue explains recency bias, a phenomenon whereby investors let short-term performance influence their decisions, and ways to counter this, instead seeing the silver lining in market volatility.

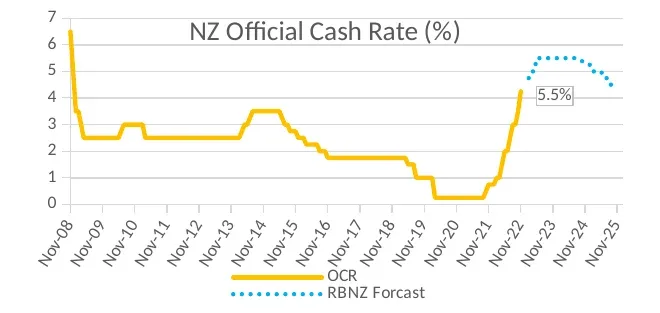

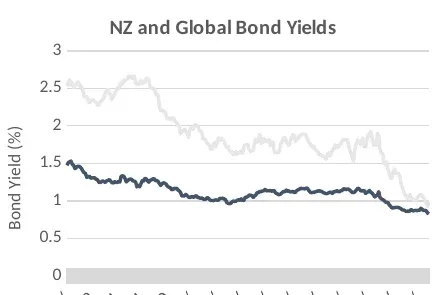

The Reserve Bank of New Zealand is getting tough on inflation. The relationship between interest rates and inflation and what this means for your investments.

This issue shows the methods used to support returns during periods of market volatility. Using the New Zealand dollar as a ‘shock absorber’.

Responsible Investing at Booster and our backing of two climate-focused investor initiatives – the Carbon Disclosure Project (CDP) and the Investor Group on Climate Change (IGCC).

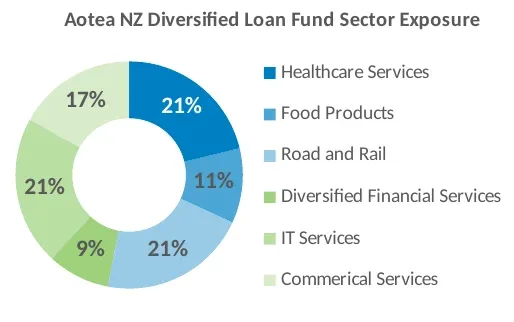

Broadening Booster’s direct investments in attractive, unlisted NZ assets – Aotea Asset Management.

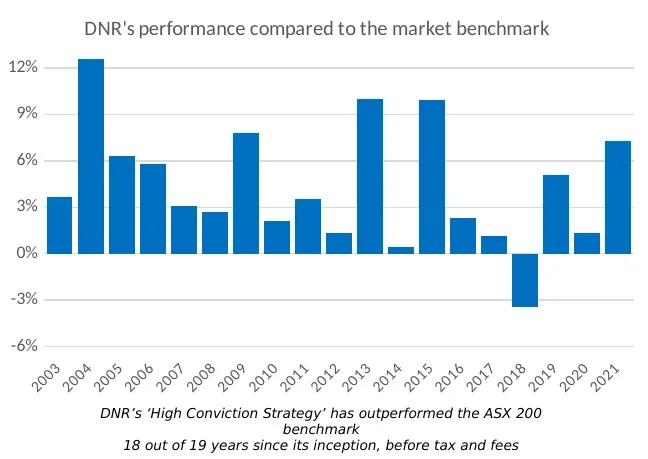

Introducing our new Australian Active manager, DNR Capital, and a taste of their investment philosophy.

This issue covers built-in ‘shock absorbers’ within your portfolio to cushion the effect of market volatility.

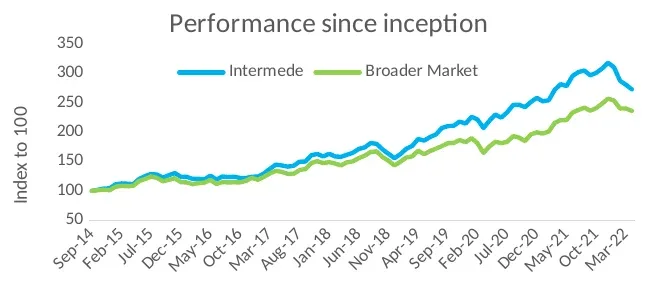

Introducing our new Active Global manager, Intermede, and a taste of some of their investments.

Widening Booster’s direct investments in attractive, unlisted NZ assets – helping local Iwi fund the purchase of 40 Wellington school properties.

The benefits of adding unlisted investments (investments that aren’t listed on publicly traded exchanges) to your portfolio. When selected appropriately, these investments tend to offer attractive returns relative to the risks involved and help support the growth of NZ businesses.

The issue digs into what the Russian invasion means for investors.

It’s been an eventful start to the year. Tensions have been rising between Russia and Ukraine and central banks around the world are looking to increase interest rates.