Newsletter – March 2025

This month we unpack what a tariff is, and some of the ways we manage portfolios during uncertain times like this.

Regular newsletters.

This month we unpack what a tariff is, and some of the ways we manage portfolios during uncertain times like this.

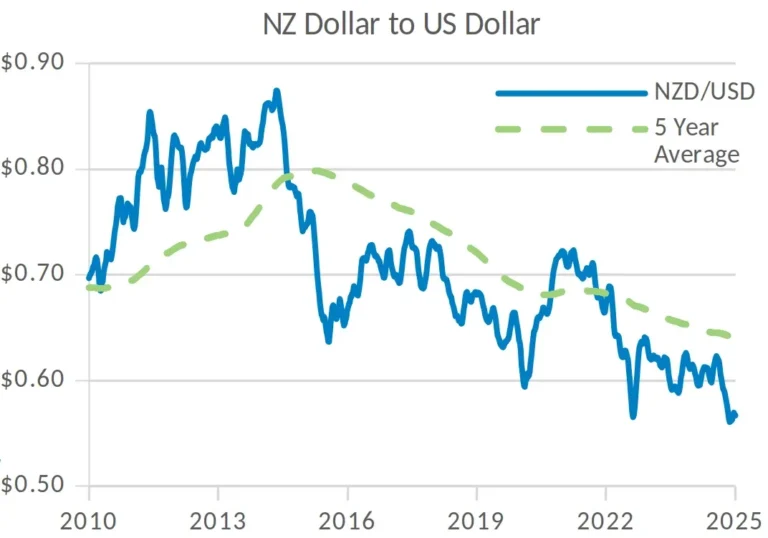

This month we discuss currency – the opportunities a weaker New Zealand dollar creates for your investments and how we cushion against currency volatility.

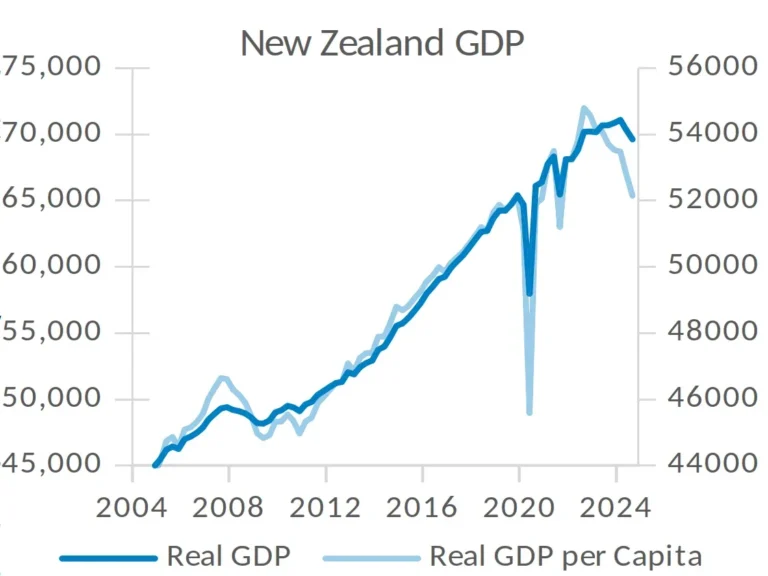

This month we check in on the NZ Economy and the role of GDP as an indicator of growth.

Our theme this month is shareholder voting and highlighting a few recent votes on resolutions that Booster, as the manager of your investments, has made on your behalf.

This month we showcase three companies within the Booster Innovation Fund – Mars Bioimaging, Hot Lime Labs and MACSO Technologies. These companies are prime examples of high-potential, early-stage investment built on NZ innovation.

Our theme this month is Trump vs Harris – what the different parties are offering and how the US Presidential election may affect the markets.

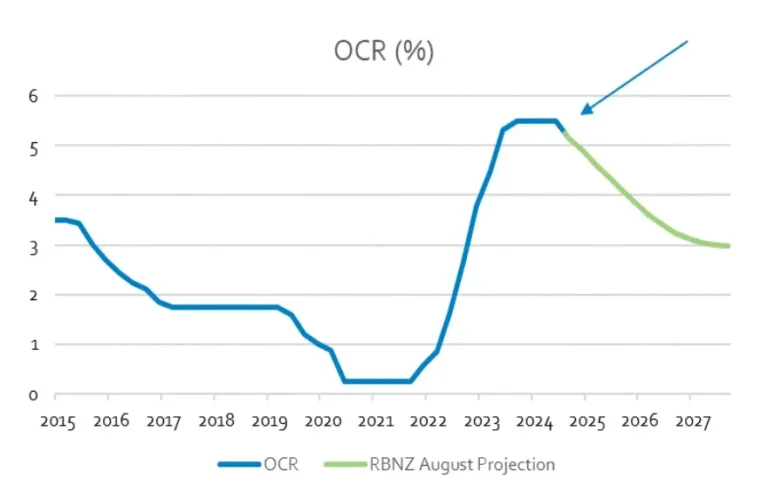

Our theme this month is interest rates. After the highest interest rates since 2008, the Official Cash Rate (OCR) was cut in August, marking the first cut since 2020. In this newsletter we outline what lower interest rates mean for your portfolio.

This month our theme is ‘shock absorbers’, the strategies we employ to reduce the effects of market volatility on your investments.

This month’s theme is the benefits of active management. Active management allows us to manage specific risks, adjust to market conditions, and uncover hidden investment opportunities. Dutch company ASML has been an exciting recent success story.

Our theme this month is diversification. Diversifying investments can mitigate risk by balancing the ups and downs of individual shares, and individual countries to reduce their impact on your entire portfolio. A diversified portfolio is more resilient because it’s designed to capture growth while providing relative security during market downturns.

This month we take a deep look at SRI vs ESG investing. A growing number of investors want to encourage companies to act responsibly in addition to delivering financial returns. ESG and SRI are often used interchangeably, but have important differences.

This month we unpack diversification. Diversification is a strategy to lower investment risk by spreading money across and within different asset classes, such as shares, bonds and cash. It’s one of the best ways to weather market ups and downs and maintain the potential for growth.