Newsletter – February 2024

This month we showcase NVIDIA, which has returned over 300% since it was added to our Californian global equity manager, Fisher’s portfolio, in July 2021.

This month we showcase NVIDIA, which has returned over 300% since it was added to our Californian global equity manager, Fisher’s portfolio, in July 2021.

Our theme this month is Albert Einstein’s Eighth Wonder of the World – The Power of Compounding.

This issue covers our human nature of feeling twice as much pain from an investment loss as we do pleasure from a gain, and while it can be tempting to view our investments daily, the key to long-term investment success is being invested over the longer term.

This issue covers what the results of the NZ general election and the conflict in the Middle East mean for investors.

This month we lift the lid on shareholder voting. Our aim is to ensure that the companies that you are invested in are well-governed, responsible corporate citizens, and acting in your best interests.

The Booster Wine Group, now the Tahi Fund’s largest investment, is an amalgamation of four prominent New Zealand wine companies spanning the Hawke’s Bay, Nelson, Marlborough, and Central Otago regions. This month we showcase the upgraded facility at the Awatere River Winery in Marlborough.

This issue covers the importance of being invested, through the highs and lows, over the longer term.

This issue covers broadening Booster’s direct investments in attractive, unlisted NZ assets – FleetPartners.

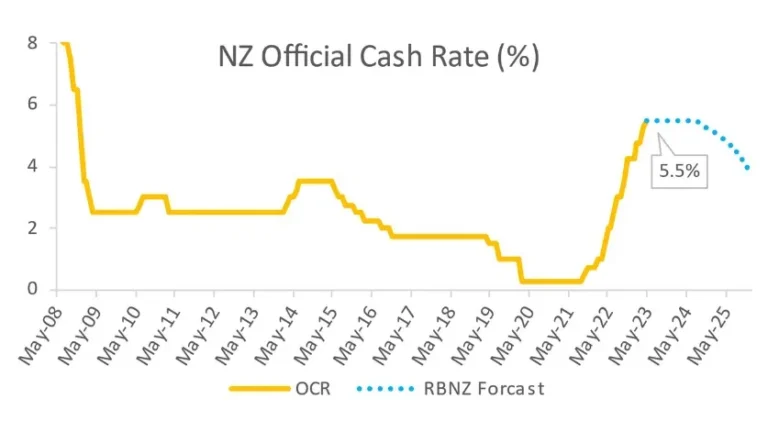

Our theme this month is the inflation taming efforts of the Reserve Bank of New Zealand and the link between inflation and interest rates.

This issue covers investing in New Zealand Innovation Fund, three exciting recent additions to the fund Opum, Captivate Technology, and TamoRx.

Recent Bank Failures: Looking through the headlines to find perspective.

This issue covers the devastation caused by Cyclone Gabrielle underscores the importance of geographical diversification.